Jubilant July: Income Tax Department registers highest ever return filing at 6.77 cr

Author: Navneet Anand & Vigya Dwivedi

New Delhi: This is one feat the Income Tax officials must be celebrating loudly, and must be complimented for with applause. Thanks to a series of programs and campaigns designed to encourage people to file their returns in time, the Income Tax Department has achieved a record of highest number of Income Tax Returned (ITR) having been filed ever. Till July 31, the Department saw a staggering 6.77 cr returns filed, about a crore more than previous year. Last financial year till July 31, 2022 5.83 cr returns were filed.

Indian Revenue Service (IRS) officials speaking to Bureaucrats India attributed this success to a fine blend of technology, psychology, communication and growing faith in governance. “A robust tech-enabled infrastructure that can handle large online traffic; gentle and regular nudges to taxpayers at frequent intervals covering all their touch points from emails to sms and social media platforms; smart, soothing and non-chaotic advertising; and people’s faith in government led to such impressive results,” said an IRS officer, not wanting to be quoted.

The data prove this point amply. Explore the data and you get jaw-dropping records that would leave any tech giant of the world wondering about the resilience and robustness of the IT infrastructure, and efficiency of the system. On the last day of filing of the return i.e, on July 31, the online e-filing portal registered its highest per hour rate of 496,559 ITRs filing between 5 to 6 pm; highest highest per second rate of ITR filing of 486 (31-Jul-2023: 16:35:06) and highest per minute rate of IT filing of 8,622 (31-Jul-2023: 17:54). Also, over 32 crore successful logins on the e-filing portal were registered between July 1 to 31, while 2.74 crore successful logins were registered on July 31 itself.

Significantly, this year has also seen widening of the tax base with about 54 lakh first-timers who filed their returns. The Department acknowledged the support of citizens: “The Income-tax Department lauds taxpayers and tax professionals for making compliances in time,” said an official note issued by Central Board of Direct Taxes (CBDT).

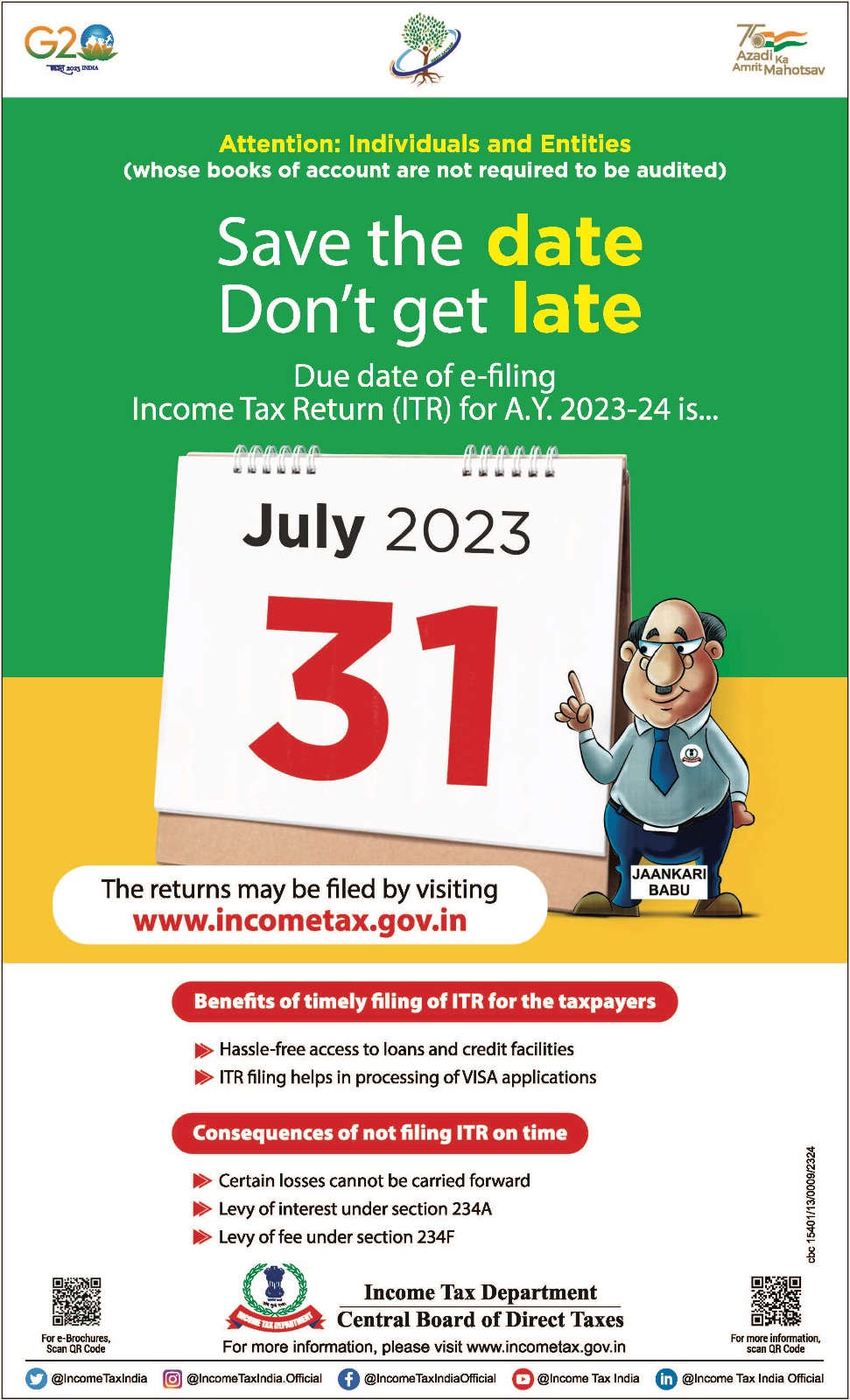

“Campaigns on Social media along with targeted e-mail and SMS campaigns were launched to encourage the taxpayers to file their ITs early. Such concerted efforts led to fruitful results with taxpayers filing their ITs for AY 2023-24 relatively earlier compared to the corresponding period of the preceding year,” said this official note. So while the one crore filing for financial year 2022-23 was recorded on July 8 in 2022, it was achieved about 12 days ahead this year on June 26.

The Department officials also informed that “It is heartening to note that a large number of taxpayers did their due diligence by comparing data of their financial transactions by viewing their Annual Information Statement (AIS) and Taxpayer Information Summary (TIS). A substantial portion of the data for ITR-1,2,3 and 4 was already prefilled with data pertaining to salary, interest, dividend, personal information, tax payment including TDS related information, brought forward losses, MAT credit etc to further ease compliance for taxpayers. The taxpayers used this facility extensively, resulting in smoother and faster filing of ITs.”

The digitalization of tax filing processes played a crucial role in streamlining the compliance procedures. More than 5.63 crore returns were e-verified, and out of these, a significant 3.44 crore ITRs (61%) were processed by July 31, 2023, ensuring efficient and timely processing of returns.

The Department had also created a new e-pay tax payment platform TIN 2.0 on the e-filing portal, replacing the earlier Protean (NSDL) based OLTAS payment system. This, according to officials, enabled provision of more user-friendly options for e-payment of taxes and making available more options for mode of payments such as Internet Banking, NEFT/RTGS, OTC, Debit Card, payment gateway and UPI. TIN 2.0 platform has enabled real time credit of taxes to taxpayers which made IT filing easier and faster. “Over 1.26 crore challans have been received through TIN 2.0 payment system in the month of July, 2023 itself, while total challans filed through TIN 2.0 since 1st April, 2023 stands at 3.56 crore,” said the release issued by Surabhi Ahluwalia, Principal Commissioner of Income Tax (Media & Technical Policy) and official spokesperson of CBDT.